Are the risks worth it? While subordinated debt is just one step higher on the ladder than hybrids in the capital structure, it is much lower risk. In this article we compare the two asset classes and some existing securities

As highlighted in the table below, there are multiple distinguishing features between Basel III compliant subordinated debt and Additional Tier 1 (AT1) hybrids. The following highlights the main features of typical structures, however, the instruments are complex and can have variations.

Subordinated debt is debt. It has a legal maturity date and defined (cumulative) interest payments that are events of default if not met. Subordinated debt is legally defined as debt and distributions are interest. For all intents and purposes, coupons must be paid when due. (The only exception is considered extremely unlikely i.e. if the payment of that coupon would place the entity into an insolvent position, then that coupon is not required to be paid but is cumulative).

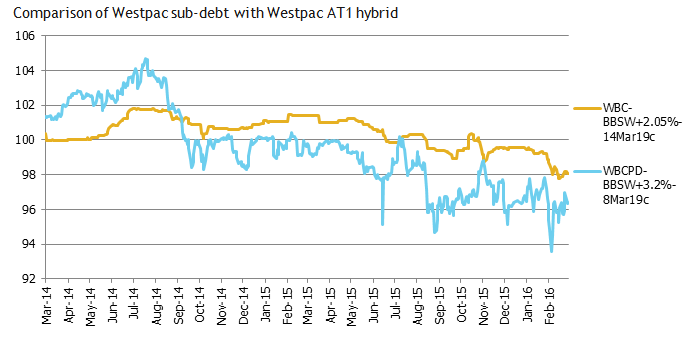

Subordinated debt has been far more stable price and margin wise than AT1 hybrids due to its closer alignment to debt. This is clearly demonstrated by the following chart of two Westpac issues, both callable in March 2019.

While new style subordinated debt (issued since 1 January 2013) has a Point Of Non-Viability (PONV) clause, this is considered an additional (but remote) risk consideration and not a defining characteristic.

Subordinated debt is considered to be closer to traditional debt securities in its structure and operation. AT1 hybrids on the other hand do exhibit many equity characteristics. They are perpetual, have discretionary, non-cumulative distributions that are significantly easier/more likely to be cancelled (as opposed to legally required interest) and AT1 hybrids are not legally defined as debt. ASIC has warned that they should not be termed fixed income.

Further, they have hard-coded conversion into equity clauses (when Core Equit Tier 1 falls below 5.125%) that would most likely be implemented before a PONV clause. Subordinated debt does not have these hard coded conversions.

AT1 hybrids also have longer terms to call date/conversion (typically 5.5 – 6 years) and mandatory conversion to equity (typically 7.5 – 8 years). AT1 hybrids are also considered a relatively high chance of ultimately being converted into equity at the conversion dates.

Importantly, regulations continue to evolve and vary across jurisdictions.

In Europe some senior bank bonds even have bail-in clauses, making them higher risk than those without. In the US, Tier 2 securities do not need explicit write-down or equity conversion features to qualify as Tier 2 Capital, whereas in Europe, Asia (including Australia) and Canada, they do.